The Financial Super App: How Revolut Rewrote the Rules of Banking and Became a $75 Billion Fintech Giant

Once in a generation, a company emerges that doesn't just compete in a market, but fundamentally rewrites its rules. In the staid, centuries-old world of banking, that company is Revolut. What began in 2015 as a simple, elegant solution to a common traveler's grievance—exorbitant foreign exchange fees—has exploded into a global financial super app valued at $75 billion. With 65 million customers across more than 48 countries, Revolut has transcended its origins to become a one-stop shop for everything money-related, seamlessly blending traditional banking with the cutting edge of finance, including cryptocurrencies and stock trading.

Founded by Nikolay Storonsky and Vlad Yatsenko, Revolut was born from a frustration with the slow, expensive, and opaque nature of legacy banking. It promised a radical alternative: a single platform to manage your entire financial life, with transparent pricing, instant transactions, and a relentless focus on the user experience. It was a vision that resonated powerfully with a generation of digitally native consumers who had grown tired of the friction and bureaucracy of traditional banks.

This article explores the meteoric rise of Revolut, from its disruptive beginnings as a multi-currency card to its current status as a licensed bank and a dominant force in the fintech revolution. We will dissect the components of its all-in-one platform, analyze its aggressive global expansion strategy, and examine how it has navigated the complex worlds of regulation and cryptocurrency to build an empire that is challenging the very definition of a bank.

More Than a Bank: The Anatomy of a Financial Super App

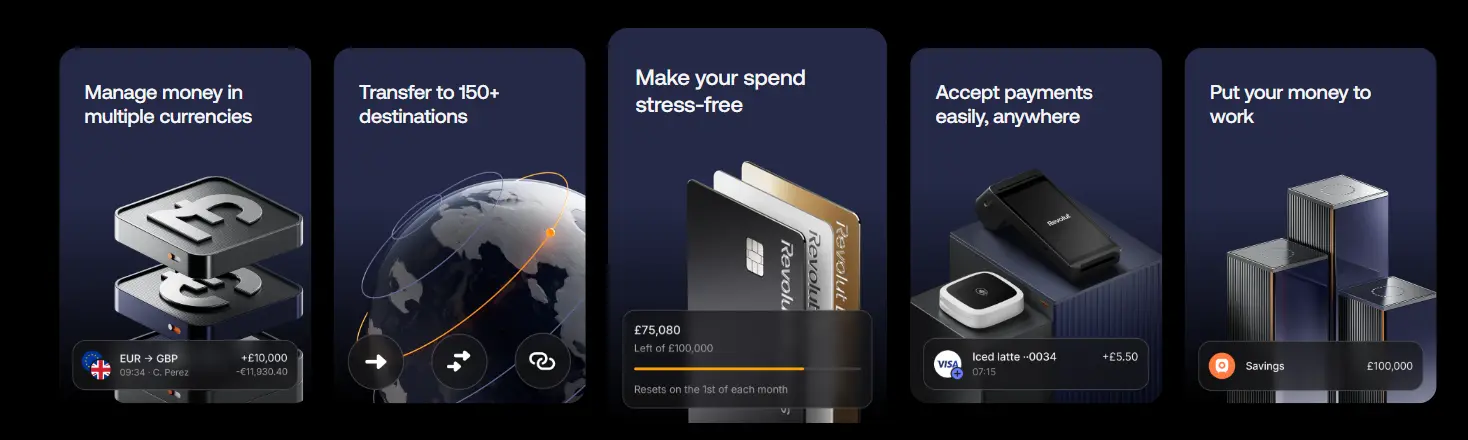

Revolut's core genius lies in its aggregation of disparate financial services into a single, intuitive mobile application. Where a traditional consumer might need a high-street bank for their current account, a separate brokerage for stocks, a crypto exchange for digital assets, and a third-party app for international transfers, Revolut offers it all under one roof. This "super app" model creates a powerful, sticky ecosystem that caters to every aspect of a user's financial life.

The platform is built on a foundation of multi-currency accounts, allowing users to hold, exchange, and transfer money in over 36 currencies at interbank exchange rates. This original feature remains a cornerstone of its value proposition, saving users billions in hidden fees. From this foundation, Revolut has systematically layered on a comprehensive suite of services that leave traditional banks struggling to keep up.

The Revolut Ecosystem: A One-Stop Financial Hub

Revolut's success is built on its ability to offer a diverse range of financial products within a single, user-friendly platform. This integrated ecosystem creates a powerful network effect, where each new service enhances the value of the others.

Streamlines international trade, simplifies expense management, empowers global businesses.

A Gateway to Digital Assets

Unlike traditional banks that have been hesitant to embrace cryptocurrencies, Revolut has leaned into the digital asset revolution, positioning itself as a safe and accessible gateway for mainstream users. The platform allows customers to buy, sell, and hold over 200 different cryptocurrencies with just a few taps, starting with as little as £1. This low barrier to entry has introduced millions of people to the world of crypto.

In 2025, Revolut deepened its commitment to the space with the launch of Revolut X, an advanced crypto exchange designed for professional traders, featuring lower fees and sophisticated analytical tools. Furthermore, its recent integration with the Polygon blockchain enables innovative features like zero-fee remittances, demonstrating a clear strategy to leverage blockchain technology to solve real-world financial problems.

The Path to Global Dominance: A Story of Hyper-Growth

Revolut's journey from a London-based startup to a global financial powerhouse has been a masterclass in aggressive expansion and regulatory navigation. The company's timeline is marked by a relentless drive to enter new markets, acquire licenses, and broaden its product suite.

After launching in 2015, Revolut quickly expanded across Europe. A pivotal moment came in 2018 when it secured an EU banking licence from the European Central Bank, allowing it to accept deposits and offer consumer credit. This was the first step in its transition from an e-money institution to a full-fledged bank.

The company's global ambitions accelerated between 2019 and 2025, with launches in Australia, Singapore, the United States, and Japan. By the end of 2024, Revolut had amassed 50 million users and held over £15.1 billion in customer deposits. This incredible growth culminated in a $75 billion valuation in November 2025, making it one of the most valuable fintech companies in the world.

In 2025, the expansion continued with a $1.1 billion investment plan for France, the acquisition of a lender in Argentina, and the securing of payment licenses in India and the UAE. This global footprint, combined with a UK banking licence (granted in 2024), has solidified Revolut's position as a truly global financial institution.

Navigating the Challenges: The Scrutiny of a Disruptor

Revolut's rapid growth has not been without its challenges. As a disruptor in a highly regulated industry, the company has faced intense scrutiny from regulators, the media, and the public. In its early years, it was criticized for its demanding work culture and high staff turnover. As it scaled, it faced a more significant challenge: balancing its automated, algorithm-driven compliance systems with the need for nuanced human oversight.

In 2020, reports emerged of customers being locked out of their accounts for extended periods after the company's automated anti-money laundering systems flagged their activity. While these systems are a necessary defense against financial crime, the incidents highlighted the customer service challenges of a rapidly growing digital-first bank. Revolut has since invested heavily in its compliance and support teams to address these issues.

Furthermore, the company has had to navigate the complex and evolving regulatory landscape for cryptocurrencies. In 2023, it was forced to halt its crypto trading services for U.S. customers, citing the uncertain regulatory environment as the SEC intensified its scrutiny of the sector. These challenges underscore the delicate balancing act that Revolut must perform as it straddles the worlds of traditional finance and decentralized technology.

Conclusion: The Unbundling and Rebundling of Finance

Revolut's story is the story of the great unbundling and rebundling of financial services. It began by identifying a single, painful friction point in the banking experience—international exchange rates—and solving it better than anyone else. From that beachhead, it systematically expanded, pulling in service after service that was once the exclusive domain of separate, specialized institutions. In doing so, it has created a powerful, all-in-one platform that offers unprecedented convenience, transparency, and control.

The company has demonstrated that a bank is no longer a physical place you go to, but a seamless, integrated part of your digital life. It has proven that customers, when given the choice, will flock to a platform that is cheaper, faster, and more user-friendly than the incumbents. While it has faced its share of growing pains, Revolut's relentless innovation, global ambition, and unwavering focus on the customer have set a new standard for what a financial institution can be.

As Revolut continues its global expansion and deepens its integration of cutting-edge technologies like blockchain, it is not just building a successful business; it is forging the blueprint for the future of finance. It is a future where your money is truly global, where financial services are accessible to all, and where the power is shifting from the institution back to the individual. The revolution is here, and it is being televised on your phone.