Unlocking the Real Estate Market: A Step-by-Step Guide to Investing in Tokenized Property

For generations, real estate has been one of the most reliable and effective ways to build long-term wealth. It offers the potential for steady passive income, significant appreciation, and a tangible asset that you can see and touch. Yet, for the vast majority of people, direct ownership of high-quality, income-producing property has remained frustratingly out of reach. The enormous capital requirements, complex legal hurdles, and lack of liquidity have created a high barrier to entry, reserving the best opportunities for the wealthy and well-connected.

But what if you could own a piece of a prime downtown apartment building for just a few hundred dollars? What if you could earn monthly rental income and trade your ownership stake as easily as a stock? This is not a futuristic dream; it is the reality of tokenized real estate, a revolutionary approach that is leveraging blockchain technology to democratize property investment for everyone.

This guide will walk you through everything you need to know to get started. We will demystify what tokenized property is, explore its game-changing benefits, and provide a clear, step-by-step process for making your first investment. The doors to the real estate market are finally opening—here’s how you can walk through them.

What is Tokenized Real Estate? A Revolution in Ownership

At its core, tokenized real estate is the process of converting the ownership rights of a physical property into digital tokens on a blockchain. Think of it as a digital deed, but one that can be divided into thousands or even millions of tiny, tradable pieces.

Here’s how it works in practice: A legal entity, typically a Limited Liability Company (LLC), is created to own a specific property—for example, a 50-unit apartment complex. The ownership of that LLC is then digitized and represented by a set number of tokens. If the LLC is valued at $5 million, it could be represented by 5 million tokens, each with a value of $1. When you buy these tokens, you are not just buying a digital collectible; you are buying a legally recognized, fractional share of the company that owns the building. This entitles you to a proportional share of the profits, primarily from rental income and the property's eventual sale.

This simple yet powerful concept fundamentally changes the rules of real estate investing, offering a host of advantages over traditional methods.

The Unbeatable Advantages of Tokenization

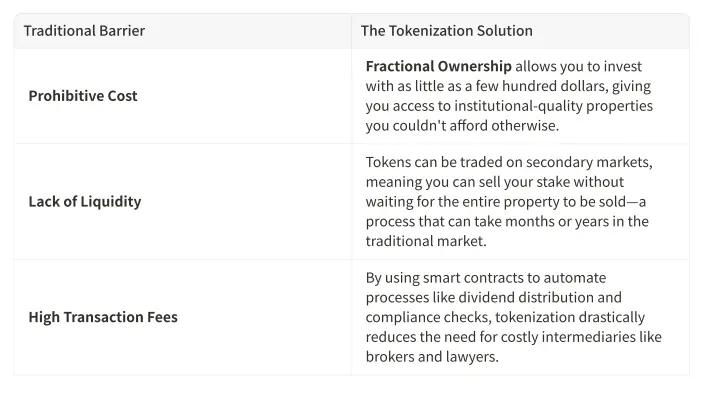

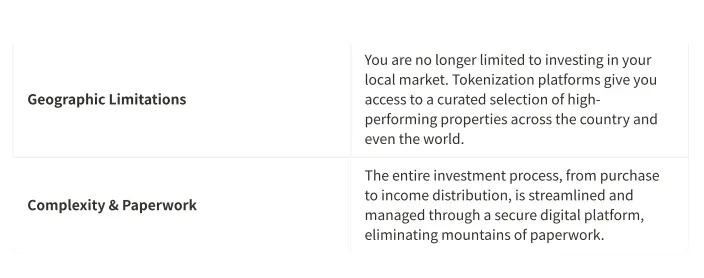

Tokenizing property solves many of the biggest problems that have plagued real estate investors for decades.

By breaking down these barriers, tokenization is not just making real estate more accessible; it is making it a more efficient, transparent, and flexible asset class for the modern investor.

Your First Tokenized Property: A 6-Step Guide

Ready to dive in? Investing in tokenized real estate is a straightforward process. Here’s a step-by-step walkthrough to guide you from beginner to property owner.

Step 1: Choose a Reputable Tokenization Platform

This is the most important step in your journey. The platform you choose will be your gateway to the market, so it’s crucial to select one that is secure, compliant, and user-friendly. Look for platforms that have a strong track record, offer insurance on digital assets, and are transparent about their legal and regulatory structure. A leading platform will handle the complex backend work—property vetting, legal structuring, and compliance—so you can focus on choosing the right investments.

Step 2: Create and Verify Your Account

Once you’ve selected a platform, you’ll need to create an account. This process is typically quick and easy, but it will involve a crucial verification step. Because real estate tokens are regulated financial securities, platforms are required by law to perform Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This involves submitting a government-issued ID and sometimes a proof of address. While it may seem like an extra hoop to jump through, this process is designed to protect you and ensure the integrity of the platform. Once approved, your account will be “whitelisted,” giving you the green light to start investing.

Step 3: Explore and Research Available Properties

Now for the exciting part: shopping for your first property. A good platform will provide a curated marketplace of available investment opportunities. Don’t just look at the pretty pictures; dive deep into the details. For each property, you should be able to access a comprehensive set of documents, including:

•The Investment Thesis: Why was this property chosen? What is the strategy (e.g., value-add, stable income)?

•Financial Projections: Detailed forecasts of expected rental income, operating expenses, and potential appreciation.

•Property Details: Information on the location, building condition, occupancy rates, and local market trends.

•Legal Documents: The Private Placement Memorandum (PPM), which outlines all the risks and terms of the investment.

Take your time with this step. Analyze the numbers, understand the market, and make sure the investment aligns with your financial goals.

Step 4: Purchase Your Tokens

Once you’ve identified a property you want to invest in, the purchase process is simple. You’ll specify the amount you want to invest, and the platform will show you the corresponding number of tokens you will receive. You can typically fund your investment using a variety of methods, including bank transfers, credit cards, or even other cryptocurrencies. After you confirm the purchase, the tokens representing your ownership stake will be deposited directly into your secure digital wallet on the platform.

Step 5: Earn Passive Income and Track Performance

This is where the beauty of real estate investing truly shines. As the property generates rental income, your share of the net profits will be automatically distributed to you, typically on a monthly or quarterly basis. These distributions are handled by smart contracts, ensuring they are timely and accurate. You can simply sit back and watch the passive income flow into your account.

Leading platforms also provide a dashboard where you can track the performance of your investments in real-time. You can monitor your total earnings, see updates on the property’s performance, and access all your tax documents in one place.

Step 6: Plan Your Exit Strategy

Unlike traditional real estate, where your capital can be locked up for years, tokenization offers much greater flexibility. You generally have two primary options for exiting your investment:

1.Hold Until Sale: You can simply hold your tokens and continue to collect passive income until the property is eventually sold by the management company. At that point, you will receive your proportional share of the sale proceeds.

2.Sell on a Secondary Market: One of the most powerful features of tokenization is liquidity. After an initial holding period (typically one year, as required by securities regulations), you can sell your tokens to other investors on the platform’s secondary market. This allows you to exit your investment on your own timeline, without having to wait for the entire property to be sold.

What Kind of Properties Can You Invest In?

Tokenization is not limited to a single type of real estate. Investment platforms offer a diverse range of property types, allowing you to build a portfolio that matches your specific investment goals. Some of the most common categories include:

•Multifamily Housing: Apartment buildings are a popular choice due to their consistent demand and stable cash flow from multiple tenants.

•Commercial Real Estate: This can include office buildings, retail centers, or industrial warehouses, which often have long-term leases with business tenants.

•Self-Storage Facilities: A resilient and growing sector that benefits from high demand and low operating costs.

•Undeveloped Land: A more speculative investment that offers the potential for high appreciation if the land is developed or rezoned in the future.

Understanding the Risks

While tokenized real estate offers incredible benefits, it is important to remember that no investment is without risk. The primary risks are largely the same as those in traditional real estate: market downturns can affect property values, unexpected vacancies can reduce rental income, and major repairs can be costly. However, by investing through a reputable platform that conducts thorough due diligence on each property, you can significantly mitigate these risks. Additionally, the ability to diversify across multiple properties and geographic locations with small investment amounts is a powerful risk management tool in itself.

Conclusion: Your Key to the Real Estate Market

For too long, the wealth-building power of direct real estate ownership has been a locked door for the average person. Tokenization is the key that is finally unlocking it. By combining the time-tested stability of real estate with the efficiency, accessibility, and liquidity of blockchain technology, it represents a true paradigm shift in the world of investing.

By following the steps outlined in this guide—choosing a secure platform, conducting thorough research, and starting with a manageable investment—you can confidently take your first step into this exciting new market. You no longer need to be a millionaire to invest like one. The world of real estate is now open for business, and your portfolio is waiting.