KYC and AML in Crypto: Why Regulation is a Good Thing for Serious Investors

In the early days of cryptocurrency, the words “regulation” and “anonymity” were central to its identity. The promise of a decentralized financial system, free from the oversight of banks and governments, was a powerful draw for pioneers and privacy advocates. However, this unregulated frontier also attracted illicit actors, leading to high-profile scams, hacks, and market manipulation that have cost investors billions and slowed mainstream adoption.

As the digital asset market matures, a new narrative is taking hold. The debate is no longer about if crypto should be regulated, but how. For the serious investor—the individual or institution focused on long-term growth and capital preservation—this shift is not a threat, but a tremendous opportunity. The implementation of robust regulatory frameworks, specifically Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, is the single most important catalyst for transforming crypto from a speculative “Wild West” into a legitimate, institutional-grade asset class.

This article will demystify KYC and AML, challenge the outdated notion that regulation is inherently bad for crypto, and explain why a compliant ecosystem is ultimately the safest and most profitable environment for those who are serious about investing in the future of finance.

Defining the Terms: What Are KYC and AML?

Before we can appreciate their benefits, it’s essential to understand what these acronyms actually mean. Far from being invasive measures, they are standard compliance practices that have been the bedrock of the traditional financial system for decades, designed to protect the integrity of the entire system.

•Know Your Customer (KYC): This is the process of identity verification. When you sign up for a compliant crypto platform, you will be asked to provide proof of your identity, such as a government-issued ID and a proof of address. This one-time process ensures that you are who you say you are, preventing fraudsters from creating fake accounts, impersonating others, or engaging in identity theft on the platform.

•Anti-Money Laundering (AML): This refers to a broader set of laws and procedures designed to prevent the illegal flow of funds. AML compliance requires financial institutions, including crypto exchanges, to monitor transactions for suspicious activity and report it to the relevant authorities. This helps to combat terrorism financing, tax evasion, and other financial crimes, ensuring the platform is not used as a tool for illicit purposes.

Together, KYC and AML form a powerful shield that protects not only the financial system but every individual participant within it.

The Investor’s Shield: How Regulation Creates a Safer Market

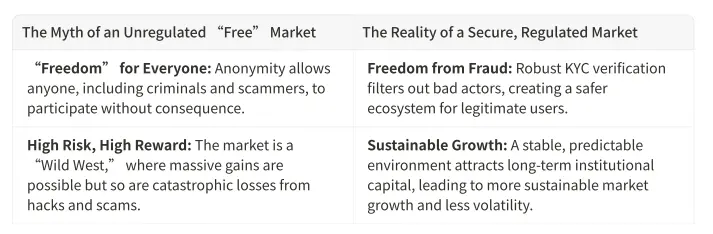

For years, the primary argument against regulation was that it undermined the core ethos of crypto: decentralization and anonymity. However, this perspective fails to recognize a critical distinction: the difference between privacy and secrecy. A regulated environment does not eliminate privacy; it eliminates the secrecy that allows bad actors to thrive. For the 99% of market participants who are investing for legitimate reasons, this is an overwhelmingly positive development.

Here is how a compliant framework directly benefits you as a serious investor:

1. Enhanced Investor Protection and Fraud Prevention

The single greatest benefit of KYC and AML is the dramatic reduction in fraud. In an unregulated environment, it is trivially easy for scammers to create fake accounts, launch deceptive projects (rug pulls), and manipulate markets. By requiring every user to verify their identity, compliant platforms make it exponentially harder for these criminals to operate. If a user engages in fraudulent activity, their identity is known, and they can be held accountable. This simple fact acts as a powerful deterrent, cleansing the ecosystem of its most dangerous elements and protecting your hard-earned capital.

2. Building Market Trust and Legitimacy

For cryptocurrency to evolve into a mature asset class, it needs to earn the trust of the global public. Widespread adoption will never happen as long as the dominant headlines are about multi-million dollar hacks and elaborate Ponzi schemes. A strong regulatory framework is the antidote to this negative perception. When investors see that platforms are implementing the same rigorous compliance standards as their bank or brokerage firm, it sends a powerful signal of legitimacy and professionalism. This trust is the foundation upon which a multi-trillion dollar market will be built.

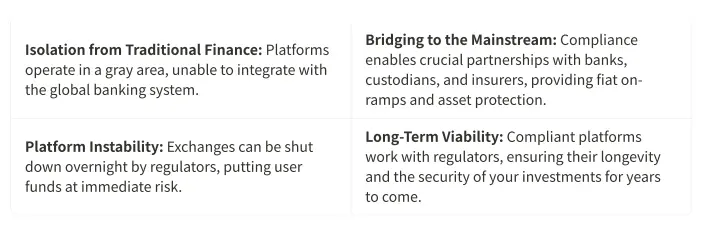

3. Paving the Way for Institutional Investment

Institutional investors—pension funds, endowments, and corporations—control trillions of dollars in capital. Their entry into the crypto market is widely seen as the catalyst for the next major bull run. However, these entities cannot and will not invest in an unregulated environment. They have strict fiduciary duties and compliance mandates that require them to use platforms that meet the highest standards of security and regulatory adherence. A regulated crypto exchange with a robust KYC/AML program is not just a preference for these institutions; it is an absolute requirement. By embracing compliance, platforms are rolling out the red carpet for the big money that will ultimately benefit every investor in the ecosystem.

4. Ensuring Platform Stability and Longevity

What is the biggest risk to your crypto portfolio? For many, it’s not market volatility, but platform risk. In recent years, numerous exchanges have collapsed or been shut down by regulators for non-compliance, often taking user funds with them. Choosing a platform that proactively works with regulators is a crucial part of risk management. These platforms are not just building for the next bull run; they are building for the next decade. Their commitment to compliance ensures they will remain operational, solvent, and secure, safeguarding your assets for the long term.

The Serious Investor’s Choice: What to Look for in a Compliant Platform

As the market bifurcates into regulated and unregulated exchanges, the choice for a serious investor becomes clear. Opting for a compliant platform is a strategic decision to prioritize security, stability, and long-term growth over the illusion of complete anonymity. When evaluating a platform, look for these clear indicators of a commitment to compliance:

•Mandatory and Thorough KYC: The platform should require all users to complete a comprehensive identity verification process before they can trade. Be wary of exchanges that offer “no-KYC” trading, as this is a major red flag.

•Partnerships with Reputable Compliance Firms: Leading platforms don’t handle compliance in-house. They partner with specialized firms like SumSub, Onfido, or Chainalysis to manage their KYC/AML processes, ensuring they are using the latest technology and adhering to global standards.

•Transparent Legal Structure: The platform should be open about its legal structure, where it is domiciled, and the licenses it holds. This transparency is a key sign of a legitimate operation.

•Institutional-Grade Security and Insurance: A commitment to compliance often goes hand-in-hand with a commitment to security. Look for platforms that offer features like cold storage for assets and significant insurance policies to protect against theft or hacks.

Conclusion: Regulation Isn’t the Enemy—It’s the On-Ramp

The narrative that regulation is the enemy of cryptocurrency is a relic of a bygone era. For the modern, serious investor, regulation is the essential on-ramp that will connect the innovative world of digital assets to the vast capital and trust of the mainstream financial system. KYC and AML are not burdens; they are the guardrails that protect you from fraud, the foundation that builds market trust, and the bridge that will bring institutional capital to the space.

By choosing to invest on a secure, regulated crypto platform, you are not sacrificing freedom. You are making a strategic choice to be part of a safer, more stable, and ultimately more valuable ecosystem. You are signaling that you are not a speculator, but an investor who understands that in the world of finance, trust and security are the most valuable assets of all.

www.sinisadagary.com