The Future is Tokenized: How Blockchain Investment Platforms Are Democratizing Finance

The financial world is standing on the precipice of its most significant transformation in a century. For decades, the architecture of investment has been dominated by centralized institutions, intermediaries, and processes that often create barriers to entry, high costs, and a frustrating lack of transparency. However, a new paradigm, powered by blockchain technology, is rapidly emerging to dismantle these old structures. This revolution, centered around asset tokenization and sophisticated digital finance platforms, is not merely a fleeting trend; it is a fundamental reshaping of how we own, manage, and trade value. By converting real-world assets into digital tokens on a secure blockchain, this new model promises to democratize access to wealth-generating opportunities that were once the exclusive domain of the ultra-rich.

This article delves into the monumental shift from traditional finance to a decentralized, tokenized future. We will explore the inherent limitations of the legacy financial system, explain how enterprise-grade blockchain frameworks like Hyperledger provide a robust solution, and unpack the transformative power of tokenizing real-world assets (RWAs). Finally, we will guide you on what to look for when choosing a modern blockchain investment platform to navigate this exciting new landscape securely and effectively.

The Inefficiencies of the Old Guard: Why Traditional Finance is Ripe for Disruption

For the average person, the world of high-finance can feel opaque and inaccessible. Investing in lucrative asset classes such as commercial real estate, private equity, or fine art has traditionally required immense capital, extensive paperwork, and a network of brokers, lawyers, and banks. Each of these intermediaries adds a layer of complexity and cost, siphoning value and slowing down transactions that can take days or even weeks to settle.

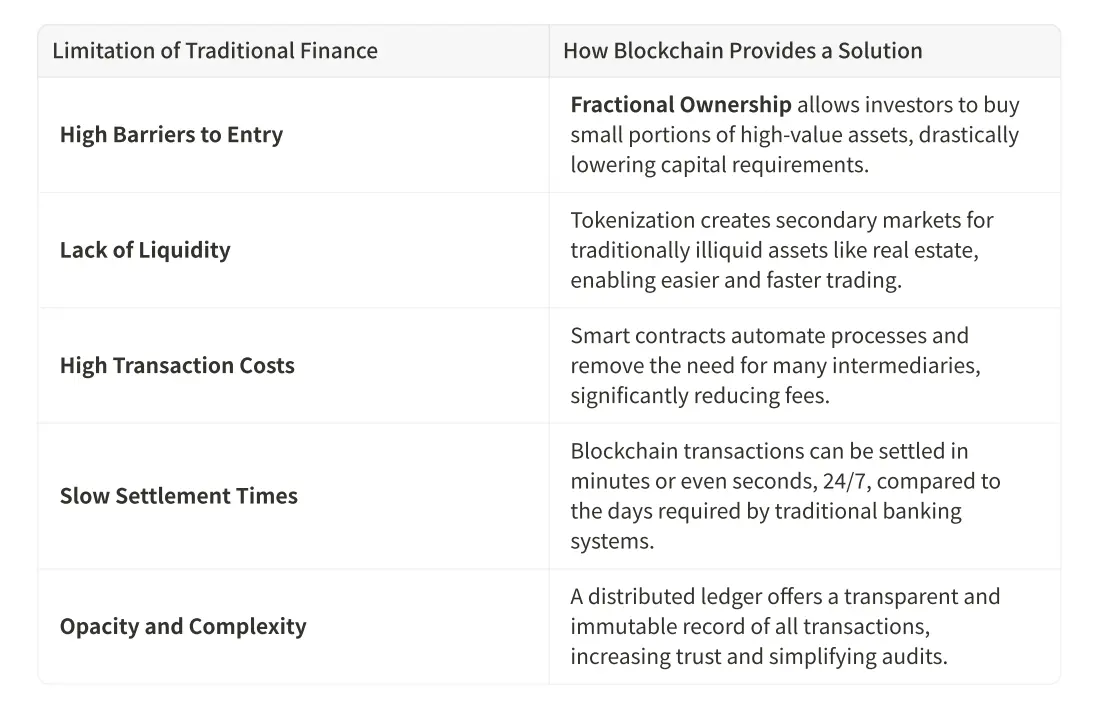

This centralized model is plagued by several key inefficiencies that a blockchain investment strategy directly addresses:

A distributed ledger offers a transparent and immutable record of all transactions, increasing trust and simplifying audits.

The result of these legacy constraints is a financial system where the most profitable ventures are often ring-fenced, leaving retail investors with a limited menu of options like public stocks and bonds. This system not only stifles opportunity but also concentrates wealth, widening the gap between institutional players and individual investors. The need for a more inclusive, efficient, and transparent alternative has never been more apparent.

A New Financial Paradigm: The Power of Enterprise-Grade Blockchain

Blockchain technology offers a powerful antidote to the ailments of traditional finance. At its core, a blockchain is a decentralized, distributed, and immutable digital ledger. Instead of a single entity controlling the records, the ledger is maintained by a network of computers, making it incredibly secure and resistant to tampering. While early blockchains were primarily associated with cryptocurrencies like Bitcoin, the technology has evolved significantly.

Enterprise-grade frameworks such as Hyperledger have been designed specifically for the rigorous demands of the business and financial worlds. Unlike public blockchains, Hyperledger provides a modular architecture that allows for private, permissioned networks. This is a critical distinction for the financial industry, as it enables platforms to control who can participate in the network and view transactions, ensuring compliance with strict regulatory requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML).

By building on a foundation like Hyperledger, a modern digital finance platform can offer a trifecta of benefits: security, transparency, and efficiency. Transactions are not only fast and low-cost but are also recorded on an unchangeable ledger, providing a clear and auditable history of ownership. This trustless environment, where participants can transact with confidence without needing to rely on a central authority, is the cornerstone of this financial revolution.

Unlocking Trillions in Value: The Magic of Real-World Asset (RWA) Tokenization

The true game-changer in the new digital economy is asset tokenization. This is the process of converting rights to an asset—whether it's a piece of real estate, a share in a startup, a bar of gold, or a work of art—into a digital token on a blockchain. Each token represents a direct, legally enforceable claim on a portion of the underlying asset. This seemingly simple concept has profound implications for investors, asset owners, and the market as a whole.

The Democratization of Ownership through Fractionalization

Perhaps the most powerful benefit of tokenization is fractional ownership. Imagine a prime commercial building worth $50 million. In the traditional system, only a handful of large institutional funds or ultra-high-net-worth individuals could afford to invest. With tokenization, that same building can be divided into 50 million digital tokens, each worth $1. Suddenly, an investor with just $100 can own a piece of that prime real estate, earning a proportional share of the rental income and potential appreciation. This opens up a world of high-quality, wealth-generating assets to a global pool of retail investors.

Injecting Liquidity into Illiquid Markets

Many of the world's most valuable assets are notoriously illiquid. Selling a building, a stake in a private company, or a rare diamond can take months or even years and involves costly due diligence and legal processes. This illiquidity ties up capital and makes it difficult for owners to realize the value of their holdings.

Tokenization shatters this paradigm. By representing ownership as a digital token, these assets can be traded on secondary markets, similar to how stocks are traded on an exchange. These markets can operate 24/7, allowing investors to buy and sell their holdings with unprecedented ease and speed. This newfound liquidity not only benefits investors by giving them more flexibility but also has the potential to unlock trillions of dollars in value currently trapped in illiquid assets across the globe.

The Rise of the All-in-One Digital Finance Platform

As tokenization becomes more mainstream, a new generation of digital finance platforms is emerging to serve as the gateway to this new investment landscape. These platforms are more than just crypto exchanges; they are comprehensive ecosystems designed to bridge the gap between traditional and digital finance. A leading platform in 2025 will integrate a multi-asset blockchain wallet, diverse investment opportunities, and robust security and compliance features into a single, user-friendly interface.

When evaluating a modern blockchain investment platform, here are the critical features to look for:

•Comprehensive Asset Support: The platform should not be limited to just cryptocurrencies. Look for support for a wide range of assets, including tokenized real estate, private equity, commodities, and traditional fiat currencies. This allows you to manage a diversified portfolio from a single wallet.

•Enterprise-Grade Security and Insurance: Security is paramount. The platform should be built on a proven, enterprise-grade blockchain like Hyperledger and adhere to the highest security standards. Furthermore, leading platforms partner with custodians like BitGo to offer significant insurance coverage (e.g., up to $100 million) to protect your assets against theft.

•Robust Compliance Framework: In a regulated financial world, compliance is non-negotiable. Ensure the platform has a stringent KYC/KYB and AML framework, monitored by reputable third-party services. This not only protects the platform from illicit activities but also ensures its long-term viability and trustworthiness.

•Seamless Onboarding and User Experience: The best technology is useless if it's difficult to use. A top-tier platform will offer a simple, intuitive onboarding process that allows you to register, verify your identity, and deposit funds in minutes. The interface for investing, trading, and monitoring your assets should be clean, clear, and accessible across both web and mobile devices.

•Transparency and Control: The platform should empower you with full control over your funds. This includes providing tools for backing up your wallet and offering a transparent, on-chain record of all your transactions. You should never have to wonder where your money is or who truly owns it.

The Road Ahead: A Tokenized Future is Inevitable

The transition from a centralized, analog financial system to a decentralized, digital one is well underway. The convergence of enterprise-grade blockchain technology, real-world asset tokenization, and user-centric digital finance platforms is creating a more inclusive, efficient, and transparent global economy. For investors, this means unprecedented access to a diverse range of asset classes and the ability to build wealth in ways that were previously unimaginable.

While the journey is still in its early stages, the momentum is undeniable. Regulatory frameworks are adapting, institutional capital is flowing into the space, and the technology is maturing at an exponential rate. Platforms that prioritize security, compliance, and a seamless user experience are poised to lead this charge, offering a secure bridge to the future of finance.

Choosing the right partner on this journey is crucial. By selecting a forward-thinking blockchain investment platform that combines the best of traditional finance with the innovation of blockchain, you can position yourself at the forefront of the most significant wealth-creation opportunity of our generation. The future isn't just digital—it's tokenized.